Start to Finish, St Charles County House Buyers Demystify the Buying Process

Start to Finish, St Charles County House Buyers Demystify the Buying Process

Blog Article

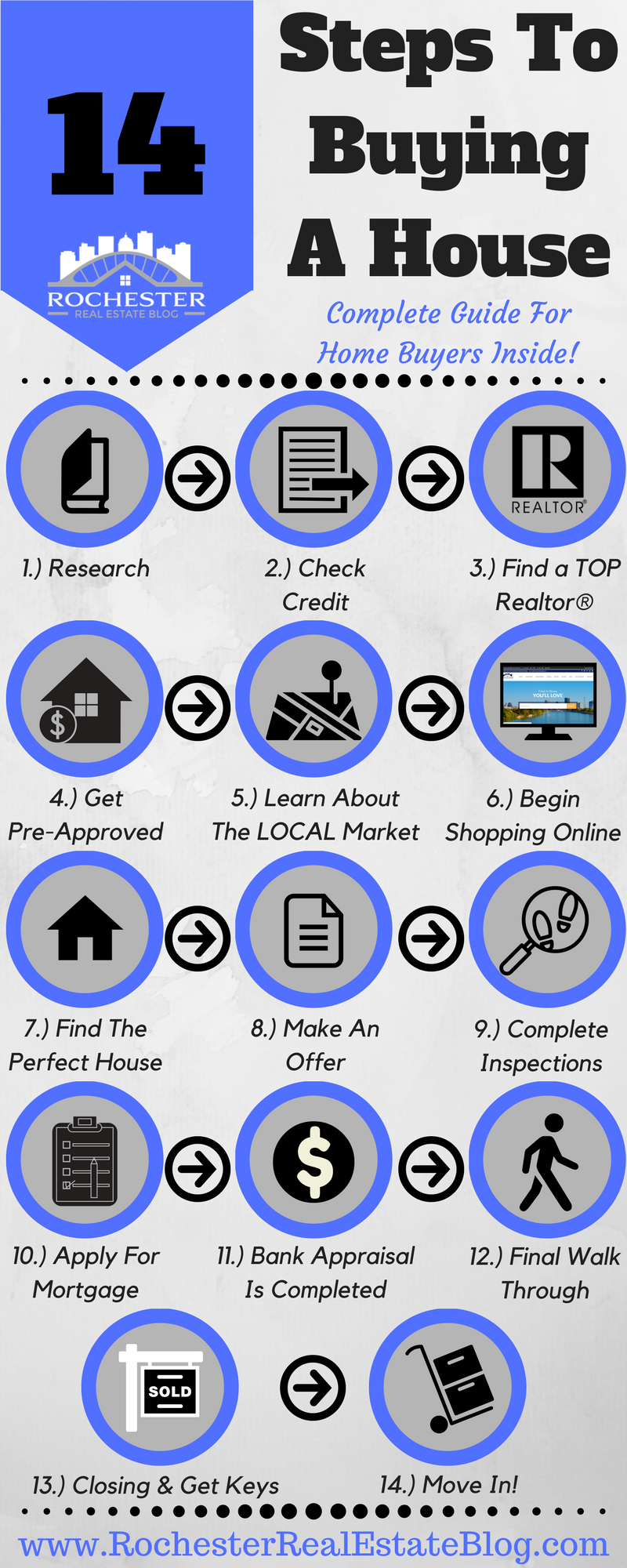

What Every First-Time Property Purchaser Requirements to Know Prior To Buying

You'll want to know what to anticipate during the home assessment and just how to navigate negotiations successfully. Allow's explore what you require to know to make informed choices.

Comprehending Your Budget Plan and Funding Options

How can you ensure you're making an audio economic decision when getting your first home? Begin by understanding your spending plan and funding options. Examine your finances by examining your income, expenses, and cost savings. Determine exactly how much you can pleasantly afford without stretching your budget plan too thin. This consists of not simply the home mortgage payments, yet also building tax obligations, insurance, and upkeep expenses.

Next, discover financing options. Think about different types of car loans, like FHA or traditional home loans, and compare rate of interest rates from different lending institutions. Do not neglect to consider the down settlement; a bigger down settlement can reduce your monthly payments and general rate of interest.

Lastly, get pre-approved for a home loan. This gives you a clear photo of your borrowing power and strengthens your position as a customer. By taking these actions, you'll identify you're economically prepared to make this considerable investment.

Researching the Local Real Estate Market

When you're all set to get, comprehending the local realty market is crucial (St Charles County House Buyers). You'll desire to evaluate market trends and contrast rates across areas to make educated decisions. This research can aid you discover the right home at the appropriate cost

Examine Market Trends

Recognizing market trends is vital for new genuine estate purchasers, as it aids you make educated decisions. Begin by investigating regional home worths, average days on the market, and the volume of sales. Utilize on the internet sources, participate in open houses, and speak with regional genuine estate representatives to obtain understandings.

Contrast Neighborhood Rates

As you dive right into the neighborhood real estate market, comparing community prices can expose beneficial insights that assist you discover the best home. Begin by investigating current sales in numerous areas and noting the average price per square foot. This information highlights which locations are more cost effective and which ones are trending up. Take note of home types, as costs can vary greatly between single-family homes, condominiums, and townhouses. Do not neglect to consider local amenities, colleges, and general neighborhood charm, as these can affect pricing. Make use of on the internet realty systems and talk to local agents to collect thorough info. By comprehending area rate variations, you'll make a more informed choice and protect a home that fits your budget and way of living.

The Importance of Obtaining Pre-Approved for a Mortgage

Getting pre-approved for a home loan is essential, particularly if you intend to stick out in a competitive property market. When you're pre-approved, you know precisely just how much you can borrow, providing you a clear spending plan to work with. This not just improves your home search yet also shows sellers you're major and economically capable.

In addition, a pre-approval helps you determine any prospective issues with your credit rating or funds at an early stage, allowing you to address them prior to you begin making offers. In most cases, vendors favor customers that are pre-approved, as it decreases the danger of funding failing later on.

Last but not least, being pre-approved can accelerate the buying process (St Charles County House Buyers). With your funding currently aligned, you can relocate promptly when you discover the ideal residential or commercial property, boosting your opportunities of securing your dream home without unnecessary delays. Take that vital action prior to diving right into your home search!

Identifying Your Must-Haves and Deal-Breakers

As a novice buyer, it's essential to identify your must-haves and deal-breakers early while doing so. Think about the necessary attributes that will certainly make a home feel like home and the non-negotiable elements that could thwart your acquisition. This browse around this web-site quality will assist you narrow down your choices and make more informed decisions.

Specify Necessary Features

When you lay out to purchase your initial home, specifying your essential features is important to making the right selection. Start by listing what you can't live without-- this could include the variety of rooms, outside space, or a garage. Assume regarding your way of living: if you enjoy cooking, a sizable kitchen area might be important. Next, recognize deal-breakers, like distance to function or school. Consider your future demands, as well; will your family members grow? Prioritize these features to lead your search and keep you concentrated. Bear in mind, you can't have all of it, so prepare to endanger on much less crucial aspects. This clearness will certainly assist you make notified decisions and discover a home that absolutely matches your requirements.

Identify Non-Negotiable Aspects

While searching for your very first home, recognizing non-negotiable elements is necessary to narrowing down your alternatives properly. Begin by recognizing your must-haves, such as the number of bedrooms, proximity to function or schools, and outside area. Take into consideration way of living needs, also-- if you're a serious cook, a modern cooking area could be a concern.

Following, determine your deal-breakers. These could include check this site out properties that need extensive repair work or areas with high crime prices. Be honest with on your own concerning what you can't compromise on; it'll save you time and irritation.

The Home Evaluation Process: What to Expect

A home inspection is an important action in the acquiring procedure, providing you a comprehensive take a look at the residential property's condition. During the inspection, a certified assessor reviews vital elements like the roofing system, plumbing, electrical systems, and structure. You'll want to exist, so you can ask questions and gain insights right into any type of issues.

Expect the examination to take a couple of hours, depending upon the residential property dimension. Afterward, you'll obtain a considerable report describing the findings. This record will certainly highlight locations requiring repair work or upkeep, assisting you make informed decisions.

Maintain in mind that no home is best-- some issues are small, while others could be significant. Depend on your impulses, and do not hesitate to consult with your genuine estate representative concerning the searchings for.

Navigating Arrangements and Making a Deal

Steering arrangements and making a deal can really feel daunting, but with the best technique, you can safeguard the home you want. When you're all set to make a deal, be clear and succinct in your interaction.

Keep your contingencies in mind, like funding and evaluation, as these secure you. official source Lastly, stay tranquil and expert throughout the procedure. Keep in mind, it's a company deal, and maintaining a favorable relationship can assist you secure the most effective offer possible.

Closing the Bargain: Last Steps to Homeownership

Closing the deal on your brand-new home involves a number of essential steps that can appear overwhelming. When that's done, it's time to set up a home evaluation.

Next, review the closing disclosure very carefully; it details your finance terms and shutting costs. Do not wait to ask questions if anything's uncertain. After that, gather your funds for closing day, which generally consists of the down settlement and additional charges.

On closing day, you'll meet the seller, your agent, and potentially a closing lawyer. You'll authorize numerous files to formally transfer ownership. After all signatures remain in area, you'll receive the keys to your new home. Congratulations! You're now a property owner, all set to make lasting memories in your new space.

Regularly Asked Inquiries

What Are the Hidden Prices of Buying a Home?

How much time Does the Home Purchasing Process Usually Take?

The home purchasing procedure normally takes a few months, but it can differ. You'll require time for research, safeguarding funding, house hunting, examinations, and closing. Persistence is essential to guaranteeing you make the best decision.

Can I Get a Home With Bad Credit?

Yes, you can purchase a home with bad credit report, however it could limit your options. Take into consideration servicing boosting your credit rating score first, or check out government programs created to help buyers with reduced credit scores.

Should I Consider a Property Agent or Go Solo?

You should absolutely consider an actual estate agent. They'll direct you via the procedure, bargain in your place, and assist you avoid pricey errors. Going solo could conserve cash, but it can also cause issues.

What Happens if I Modification My Mind After Making an Offer?

If you alter your mind after making a deal, you'll generally shed your earnest cash down payment. It's important to comprehend your agreement's terms and consult your representative to discover any potential consequences or choices.

Report this page